USD /JPY trading analysis

Current trend

The USD/JPY pair is testing the resistance level of 148.00, reacting to the publication of poor macroeconomic statistics and the results of the Bank of Japan meeting.

The national consumer price index fell from 3.3% to 3.2% in August, while core inflation remained at 4.3%. Jibun Bank’s manufacturing PMI fell from 49.6 points to 48.6 points in September, while analysts had expected an increase to 49.9 points. The Bank of Japan kept monetary policy parameters unchanged and did not focus on the prospect of abandoning negative rates in the future. The easing will be implemented by purchasing government bonds without setting an upper limit and keeping their yield close to zero. In addition, the regulator will continue daily purchases of 10-year securities at a consolidated rate of 1.0% and ETFs and J-REITs with upper limits of 12.0T yen and 180.0T yen, respectively. Officials noted that the economic recovery continues at a slow pace and the current dovish rhetoric needs to be maintained until price pressures ease and wages return to stable levels.

The American dollar is trading just above 105.000 on the USD Index. In the evening, the publication of reports on business activity indices is expected: the indicator in the manufacturing sector may continue to grow moderately, remaining above the 50.2 points recorded in August, and in the services sector it may rise from 50.5 points to 50.6 points. Finding values above the stability threshold of 50.0 points will support the US currency.

Support and resistance

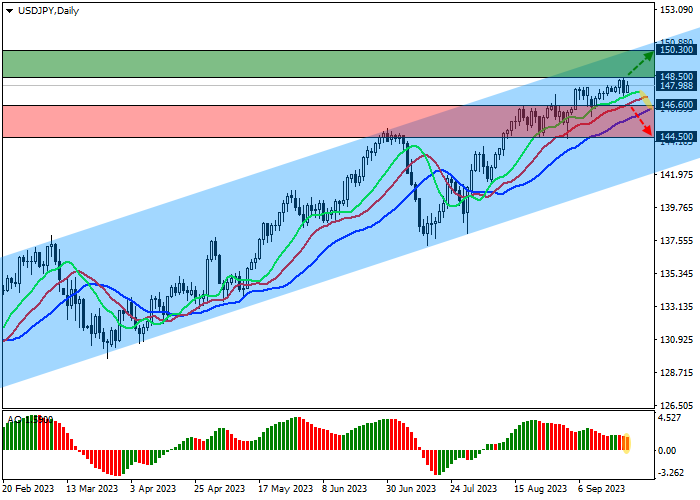

On the daily chart, the trading instrument is moving within an ascending corridor with dynamic boundaries of 151.00–142.00.

Technical indicators are strengthening the buy signal after a local correction: fast EMA on the Alligator indicator are moving away from the signal line, and the AO histogram is forming corrective bars in the buy zone.

Resistance levels: 148.50, 150.30.

Support levels: 146.60, 144.50.

Trading tips

Long positions may be opened after the price rises and consolidates above 148.50 with the target at 150.30. Stop loss – 147.80. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 146.60 with the target at 144.50. Stop loss – 147.30.

Comments

Post a Comment