EUR/USD: downward trend amid poor macroeconomic statistics from the EU.

Current trend

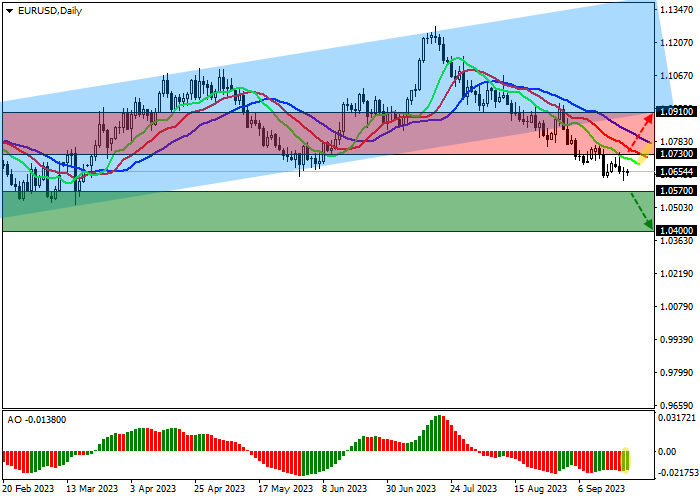

During the Asian session, the EUR/USD pair is consolidating near the 1.0655 mark after declining and renewing the lows of March 17 yesterday, leveled by the end of the day.

Today, the publication of statistics on Spain’s Q2 gross domestic product (GDP) is expected: analysts expect growth of 0.4%, which could slow the increase in the annual figure from 4.2% to 1.8%. The key data for Friday is the reports on business activity: services PMI in Germany may decrease from 47.3 points to 47.2 points, and in France – may remain at 46.0 points. Against the background, the EU service PMI may adjust from 47.9 points to 47.7 points, remaining in the red zone.

The US currency remains above 105.000 in the USD Index, despite a poor report on sales in the secondary housing market, which reflected negative dynamics from 4.07M to 4.04M compared to forecasts for growth to 4.10M. Manufacturing activity indicator from the Federal Reserve Bank (Fed) of Philadelphia in September adjusted from 12.0 points to –13.5 points. There is a lack of key publications today, and the dollar is likely to remain at the current levels.

Support and resistance

On the daily chart, the trading instrument is correcting, falling below the support line of the global ascending corridor, and remains around 1.0650.

Technical indicators strengthen the sell signal: fast EMA on the Alligator indicator are below the signal line, expanding the range of fluctuations, and the AO histogram forms corrective bars in the sell zone.

Resistance levels: 1.0730, 1.0910.

Support levels: 1.0570, 1.0400.

Trading tips

Short positions may be opened after the price declines and consolidates below 1.0570 with the target at 1.0400. Stop loss – 1.0610. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 1.0730 with the target at 1.0910. Stop loss – 1.0670.

Comments

Post a Comment